One of the most common ways to send money today is through what’s known as an ACH transfer.

In 2021, over 29 billion payments totaling $72 trillion were sent using ACH transfers. Despite this, consumers and businesses often lack an understanding of how these payments work on the back end.

Many people have likely sent numerous ACH transfers already, even if they do not know it. Paying for a subscription service directly out of a bank account, for example, is most likely to be accomplished via ACH debit transfer. When sending funds to a friend’s bank account, the action is likely carried out through an ACH credit transfer.

In this guide, we’ll cover questions such as what are the different types of ach transfers, how much does it cost to use and accept ach payments, what information is needed for an ach transfer, and more.

Let’s begin by looking at the definition of an ACH transfer.

Contents

- What is ACH transfer and how does it allow people to accept payments?

- Types of ACH electronic funds transfers

- How long does an ACH electronic fund transfer take to process?

- How much does ACH payment collection cost?

- How do ACH payments compare to other payment methods?

- Use cases for ACH transfers

- Restrictions on ACH transfers

- Better alternative to ACH payments

What is ACH transfer and how does it allow people to accept payments?

An ACH transfer is an electronic transfer of money made between banks. The transfer occurs across what is known as the Automated Clearing House (ACH) network.

Some common uses for ACH transfers include monthly debits for recurring payments like subscriptions, and direct deposit of paychecks. Many merchants allow consumers to pay bills online using ACH. Doing so requires little more than a bank account number and routing number.

ACH Payments can clear quickly, but often take several business days due to the way they are processed along with precautions taken against money laundering and fraud.

Many payment processors – like Zelle, Venmo, and PayPal – use the ACH network to allow customers to send money to their friends and family.

The information needed to make an ACH payment includes:

- Bank account number

- Routing number

- Name

- Type of bank account, either business or personal

- Amount of the transaction

Most banks will have a simple online form to fill out that includes fields for each of the categories above.

Types of ACH electronic funds transfers

What are the different types of ACH transfers? There are two main types of ACH transfers. These include:

- ACH debit transfers occur when money gets debited from an account. This is the type of transfer that happens when setting up a recurring subscription payment, for example.

- ACH credit transfers involve moving electronic funds to different bank accounts, whether that includes your own accounts or those of friends and family members.

In essence, debit transfers involve payments, while credit transfers move money between accounts.

How long does an ACH electronic fund transfer take to process?

An ACH transfer can take several business days to be processed and finalized.

Does the day of the week affect how long your transfer will take? Because business days are considered to be days that are not weekends or holidays, the answer is yes.

ACH transfers get processed in bundles, and this processing only happens seven times daily. Wire transfers, by contrast, are processed in real-time.

According to rules established by the National Automated Clearing House Association (NACHA), transfer time varies for ACH debits vs ACH credits. For debits, transactions have to be processed the following business day. For credits, a financial institution can decide whether they want transactions to be processed on the same day or in 1 – 2 business days.

Upon receipt of the funds, a credit union or bank could also choose to hold the money for a time, meaning the total timeframe for a transaction to settle can vary from institution to institution.

Banks have the ability to process payments the same day due to NACHA rules. However, each bank can choose whether or not to charge customers for expediting payments.

How much does ACH payment collection cost?

As is the case with ACH transfer speed, ACH payment cost can also vary. There is no set price for ACH payments.

For ACH credit transfers, some banks charge a fee of approximately $3 for moving money between accounts at different financial institutions. Other banks offer such transactions for free.

ACH debit transfers and usually free. Customers who require expedited bill payments may have to pay a fee, as mentioned.

Payments made through a bank or third-party payment processor like PayPal often come with a small fee. This fee may be a flat amount per transaction, a percentage of the total amount of money sent, or both.

How do ACH payments compare to other payment methods?

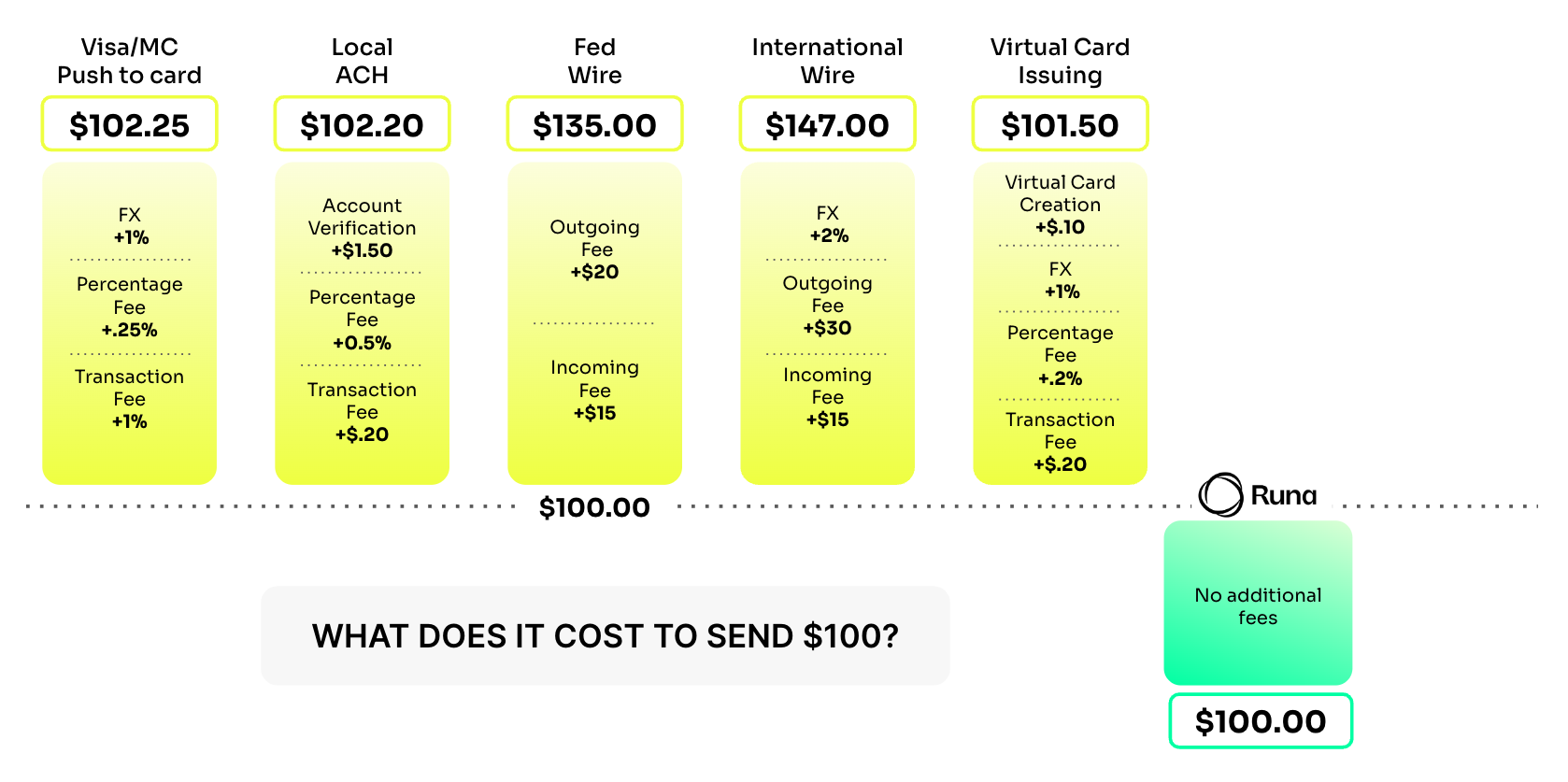

There are many other ways to transfer money beyond using the ACH network. Some of these methods include wire transfers, push-to-card payments, and eChecks.

Let’s look at each of these in more detail and compare them to ACH payments.

ACH transfer vs wire transfer

Wondering how wire transfers work and how they compare to bank transfers?

Wire transfers tend to be a lot faster and much more expensive than ACH transfers. A domestic wire transfer may only take a matter of minutes or hours, as opposed to several days for ACH transactions.

A wire transfer usually costs between $20 to $30 and also includes a fee for the person receiving one. But unlike the ACH network, the wire network processes transactions in real time. This makes wire transfers deliverable during the same day they are sent, within hours or even minutes.

What information do you need to send a wire transfer? Sending a wire requires a few pieces of information, such as:

- Full name

- Address

- Phone number

- Bank account number

- Routing number

- Name of the bank that will receive funds

- SWIFT number (for international payments)

When sending an invoice to a business that intends to send a wire transfer, including the above information will be necessary.

What is the best option when choosing between ACH payments and wire transfers? The answer will depend upon factors such as how quickly the funds need to be received. Wires are most often used for larger payments that need to be settled in short-order, or for international payments where banks do not allow for the ACH network to be used.

ACH transfer vs push to card payments

Push-to-card payments allow for real-time transfer of funds. The process is simple: consumers provide debit card details such as their PAN and expiration date, and funds are moved into the linked bank account.

Pushing funds to a bank account from digital wallets like PayPal or Venmo also constitutes a type of push payment.

While these payments are most commonly used for peer-to-peer transactions, there are other use cases as well. Businesses may have an interest in providing this kind of instantaneous transaction experience that many consumers have become accustomed to. Doing so could help retain customers by making the payment process more user-friendly.

ACH transfer and eCheck payments

Are ACH transfers the same as eChecks? Not exactly.

Both ACH transfers and eChecks are forms of electronic funds transfers (EFTs), or ways to move money from one bank account to another.

An eCheck mimics the form of payment that happens when paying by paper check, only everything is done electronically. When a eCheck gets processed, the funds are usually sent through an ACH transaction. So, eChecks are often one kind of ACH transaction. However, this does not mean that every ACH transfer is an eCheck.

Use cases for ACH transfers

There are many different use cases for ACH transfers, including but not limited to:

- Paying bills: ACH transfers can be used to pay bills, whether they are recurring or one-time payments. Things like medical expenses, utility bills, and rent payments are ideal for using ACH payments.

- Paying taxes: When paying taxes to the IRS, individual taxpayers can pay electronically via ACH transfer. Businesses can use ACH payments in their accounting to make payments easy and quickly.

- Subscriptions & memberships: Whether it’s a consumer paying for a subscription or a business selling a membership, setting up a recurring ACH transaction allows for payments to be made on-time continuously.

- Services: Contractors like freelancers and therapists can be paid using ACH transfers to make sure the billing process happens in a timely manner.

- Account transfers: Perhaps the simplest use of an ACH transfer involves moving money from one personal bank account to another. This can be used as a method of sending money to friends, family, or an account at a different financial institution.

- Donations: Non-profit organizations can also use ACH payments for accepting donations, eliminating the need to use paper checks or credit cards.

Restrictions on ACH transfers

Some financial institutions place certain restrictions on the way ACH payments can be used, including:

- Savings account transfer limits: While checking accounts typically have no limits placed on how many withdrawals and transfers can be made, savings accounts can be different. Most banks start charging fees when customers place more than six withdrawals or transfers in a given month.

- International restrictions: Banks often don’t allow for ACH payments to be made internationally. Wire transfers are often used for this type of transaction.

- Fees for lack of funds: When attempting to transfer an amount of money in excess of the funds present in an account, a bank may charge a fee and halt the transfer.

- Amount limits: Some banks may place a cap on how much money can be transferred via ACH, on both daily and monthly timeframes.

- Time limits: Because ACH transfers are processed in batches, there can be cutoff times for when they go through. After a particular time of day, transfers are not processed until the following business day. When sending a transaction on a Friday evening, for example, the transfer might not be finalized until the next Wednesday.

Better alternative to ACH payments

Traditional payment rails don’t jive well with low-volume, high-velocity transactions. Wait times tend to be long and fees can be high, especially for international payments.

You may be asking yourself: what are your alternatives to ACH money transfers?

Look no further.

Runa enables digital value transfer at lightning-speed for a fraction of the cost of an ACH payment.

Runa’s infrastructure and network facilitates payouts, helping businesses expand their reach, retain their users while modernizing the way in which they manage and transfer money: instantly, internationally, and free of charge for the senders and the recipient.

Learn more and book a demo with Runa today!

.png)