Runa Assure

Upgrade your payouts security and stay one step ahead in a world of evolving risks.

Runa is the payout solution fueling today’s high-growth platforms

Proactive protection built around you

Runa Assure goes further to protect your payouts and power your business

Protect your recipients

Ensure GDPR-compliant data security and fraud prevention, so recipients get their payouts without risk.

Protect your revenue

From the moment funds enter your account, every transaction is safeguarded, keeping your money exactly where it belongs.

Protect your growth

Runa Assure automates payout protection, freeing your teams to focus on your product and user experience.

Rest assured that your payouts are in safe hands from start to finish

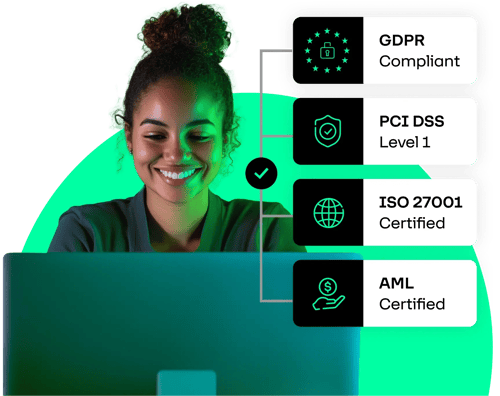

Cut compliance complexities

Runa’s platform meets the highest compliance standards, including KYC/KYB, AML, GDPR, and PCI DSS Level 1. With ISO 27001 certification and built-in security, your payouts stay compliant, secure, and worry-free.

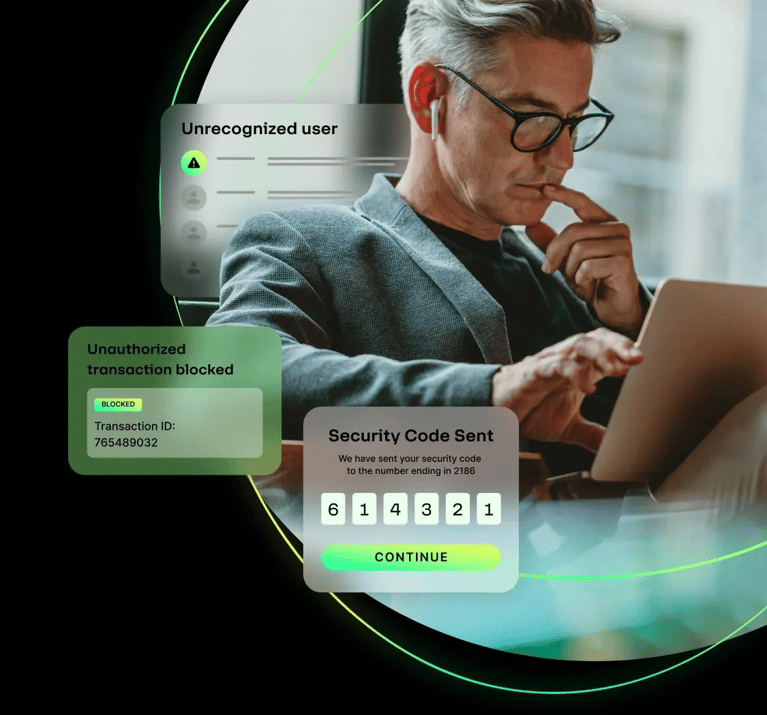

Proactive fraud prevention, built-in

Runa safeguards every transaction with IP allowlisting, multi-factor authentication, and custom order limits. Our real-time fraud detection and automated monitoring prevent unauthorized access and reduce risk.

Rest easy with data encryption

Runa protects your data with enterprise-grade encryption, multi-factor authentication, and continuous vulnerability assessments. With DDoS protection, environment segregation, and third-party penetration testing, your data stays safe—24/7.

Focus on your business while Runa protects your payouts

Runa Assure manages and mitigates all risks and threats so you don’t have to worry

24/7 tracking

Runa Assure tracks payouts in real-time, ensuring funds reach recipients securely.

Proactive protection

Runa Assure flags suspicious activity with automated detection and human intervention.

No costly delays

Runa’s expert support keeps your payouts running smoothly without interruptions.

Seamless security

Built-in encryption and fraud detection drives additional payout security.

Zero red tape

Runa Assure helps your business meet strict global compliance and security standards.

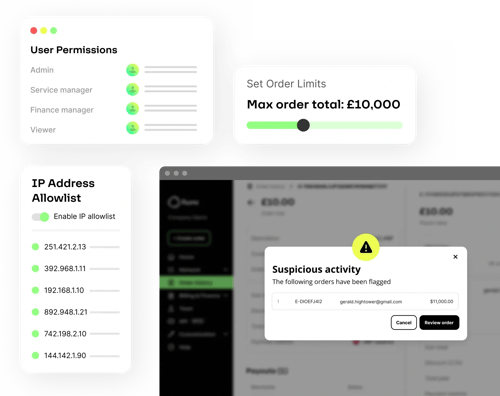

Customizable controls

Tailor role-based action controls and spending limits to align with your needs.

Hear what our customers say about their experience with Runa

Anytime I use Runa for incentives, my team loves it because they have so many options and they have the freedom to choose.

Nate R.

Verified Independent Review on G2

Runa provides exceptional service for our digital reward needs.

Luke F.

Verified Independent Review on G2

Runa makes it so easy for me to reward my team from one platform but still give them options.

Verified User

Verified Independent Review on G2

You may also be interested in

Frequently asked questions

Runa takes a security-by-design approach. Runa Assure is built into the Runa Platform already so there is no action required for customers. All Runa Platform users will automatically benefit from all of Runa’s security, compliance and anti-fraud functionality.

Runa goes beyond basic security measures, deploying robust preventative and proactive security protocols. From the moment they land in you balance to the point they have arrived with the recipient, Runa proactively monitors your funds and data. With Runa, you can rest assured that your payouts are in safe hands – landing security in the right place.

Runa Assure includes the following:

- IP allowlisting

- Customer role base access controls (RBAC)

- Order limits

- Suspicious User Analytics (UBA)

- Multi-factor authentication (MFA)

- Credit/Debit card fraud detection

- ISO27001

- KYB/KYC

- AML/Sanctions

- GDPR

- PCI DSS SAQ A 4.0 (Merchant Level 2)

- Data encryption

- Vulnerability management

- Incident response

- Security awareness training programs

- Data backups

- Production environment segregation

- DDOS Protection

Take your payouts to the next level

Find out how to easily integrate prepaid cards for simple, seamless payouts.

.webp?width=1728&height=948&name=Runa-assure-blog-tile%20(1).webp)